Web3 dakine

12 published postsKusama’s 2026 Reset: 10,000,000 DOT Is Now Funding the Next Wave of Experiments

I’ve been asking myself what Kusama is really for in 2026, and this update finally made it click. 10,000,000 DOT has now been activated to fund 24 months of fearless experimentation on Kusama, across Proof of Personhood, Zero Knowledge, and Art plus Social Experiments. In this thread, I broke down what it means, what each bounty is targeting, and how builders and creators can apply directly to the curators. Link: https://x.com/i/status/2021498573524017396

Amendment No. 7: How the SEC Wants Institutions to Touch DOT

I read 21Shares Polkadot ETF Amendment No. 7 and broke down the exact structure behind it. This post explains the rules and mechanics that shape how institutions are allowed to access DOT through a US listed spot trust. Link: https://x.com/i/status/2020543253603369308

What the 21Shares Polkadot ETF Filing Reveals About Institutional DOT

I went through Amendment No. 6 of the 21Shares Polkadot ETF as filed with the SEC on January 20, 2026. Line by line.. This is a breakdown of how the product is actually structured, how DOT is held, priced, custodied, and potentially staked, and what the filing reveals about how DOT is being positioned inside institutional market infrastructure. Link: https://x.com/i/status/2013869208749142158

What is happening on Polkadot right now?

A concise explanation of what is actually happening in the Polkadot ecosystem right now. This post provides context around governance reforms, architectural changes, and economic decisions that are often misunderstood. It explains why things feel quieter, why processes are stricter, and how these shifts fit into Polkadot’s long term design. If recent changes have felt confusing, this is the missing context. Link: https://x.com/i/status/2010788881692524832

Understanding Polkadot’s 2025 Choices

I used this thread to reflect on Gavin Wood’s 2025 Polkadot roundup from my own perspective. Instead of listing features or milestones, I focused on the deliberate decisions Polkadot made last year. The work around reducing complexity, restructuring the core, and laying foundations that only reveal their value with time and how 2025 is a year that will make more sense in hindsight, with 2026 being where those choices start to show their weight. Link: https://x.com/i/status/2006724028862439767

Revive activation on kusama network

A thread on Kusama moving from approval to execution. Revive entering enactment after governance passed, bringing Ethereum compatible smart contracts to Kusama Hub. A follow up quote post highlighting the changes made after the enactment occured and the upgrade went live on chain. Link : https://x.com/i/status/2005580117675024811

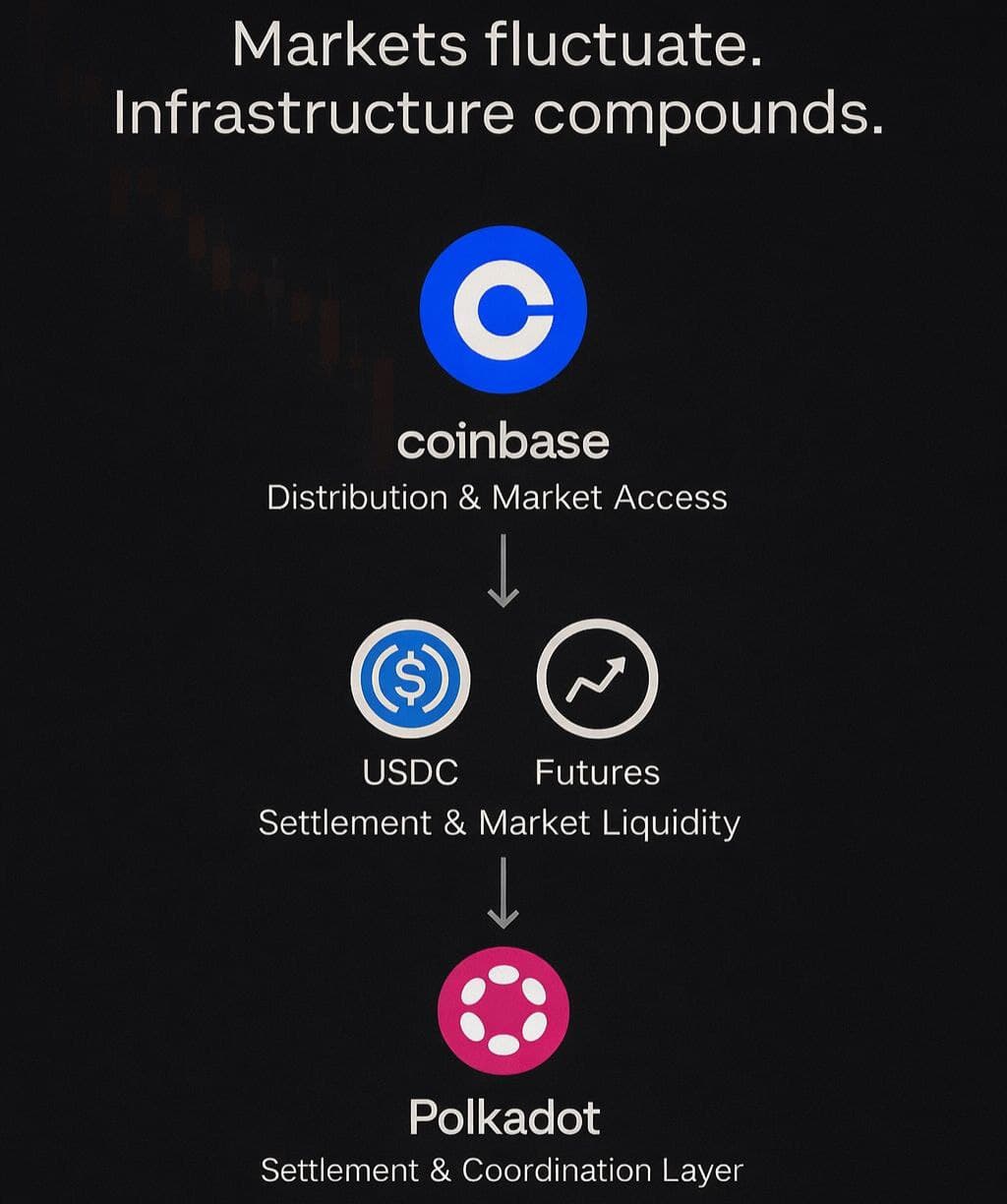

Coinbase, USDC, and the Infrastructure Layer Around Polkadot

This thread is about how Polkadot is being wired into real market infrastructure through stablecoin rails and regulated derivatives, and why that matters more than short term price action. Link : https://x.com/i/status/2000808113113362864

How Polkadot Changes Application Design

Polkadot is changing how applications are built. The Polkadot Hub brings assets, identity, governance, staking, and smart contracts into one environment, reshaping how builders ship real products. This video walks through that shift and what it unlocks. Link: https://x.com/i/status/2001321506526089660

Polkadot is a dead ecosystem

A reality check for anyone still calling Polkadot “dead”. This post pulls together recent signals across dev activity, institutions, DeFi, gaming, infrastructure, and real users. When you line them up, the picture is clear. Things are moving fast and in public. Link: https://x.com/i/status/1998996223584276988

Polkadot tipping 101. The Sacred way.

A post that contains a video tutorial showing how to send and receive tips with Sacred Protocol. It also highlights campaigns you can join if you want to earn tips in the Polkadot ecosystem. Link https://x.com/__dakine/status/1992840597460091351?t=eoSjnmqW6OAqebWgBCGepA&s=19